nebraska sales tax rate

30 rows The state sales tax rate in Nebraska is 5500. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Nebraska Sales Tax Rate Changes January And April 2019

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription.

. With local taxes the total sales tax rate is between 5500 and 8000. The use tax rate is the same as the sales tax rate. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

FilePay Your Return. The base state sales tax rate in Nebraska is 55. What is the sales tax rate in Lincoln Nebraska.

In addition to taxes car. Printable PDF Nebraska Sales Tax Datasheet. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up.

Change Date Tax Jurisdiction Sales Tax Change Cities Affected. Municipal governments in Nebraska. The minimum combined 2022 sales tax rate for Aurora Nebraska is.

Sales and Use Taxes. Sales Tax Rate Finder. See the County Sales and Use Tax Rates section at the.

49 rows 75 Sales and Use Tax Rate Cards. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Find your Nebraska combined state.

Waste Reduction and Recycling Fee. The minimum combined 2022 sales tax rate for Nemaha Nebraska is. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05.

What is the sales tax rate in Nemaha Nebraska. NE Sales Tax Calculator. 536 rows Nebraska Sales Tax55.

Average Sales Tax With Local. Businesses are responsible for paying. Counties and cities can charge an.

This is the total of state county and city sales tax rates. Nebraska levies a property tax on all real and personal property within the state. Nebraska Application for Direct Payment Authorization 122020 20DP.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. ArcGIS Web Application - Nebraska. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The Nebraska state sales and use tax rate is 55. This is the total of state county and city sales tax rates.

Nebraska sales tax details. Omaha collects a 15. This is the total of state county and city sales tax rates.

What is the sales tax rate in Aurora Nebraska. The Nebraska NE state sales tax rate is currently 55. The Nebraska state sales and use tax rate is 55 055.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Groceries are exempt from the Omaha and Nebraska state sales taxes. Raised from 6 to 65.

Nebraska has recent rate changes Thu Jul 01. Groceries are exempt from the Nebraska sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

For other states see our list of nationwide sales tax rate changes. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

Nebraska Sales Tax Sales Tax Nebraska Ne Sales Tax Rate

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nebraska Sales Tax Exemptions Agile Consulting Group

Sales Tax Laws By State Ultimate Guide For Business Owners

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

States With The Highest And Lowest Sales Taxes

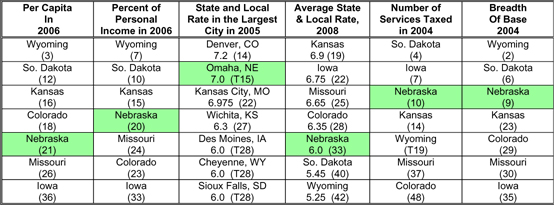

Pro Growth Tax Reform Through Broadening Sales Tax Itr Foundation

How To File And Pay Sales Tax In Nebraska Taxvalet

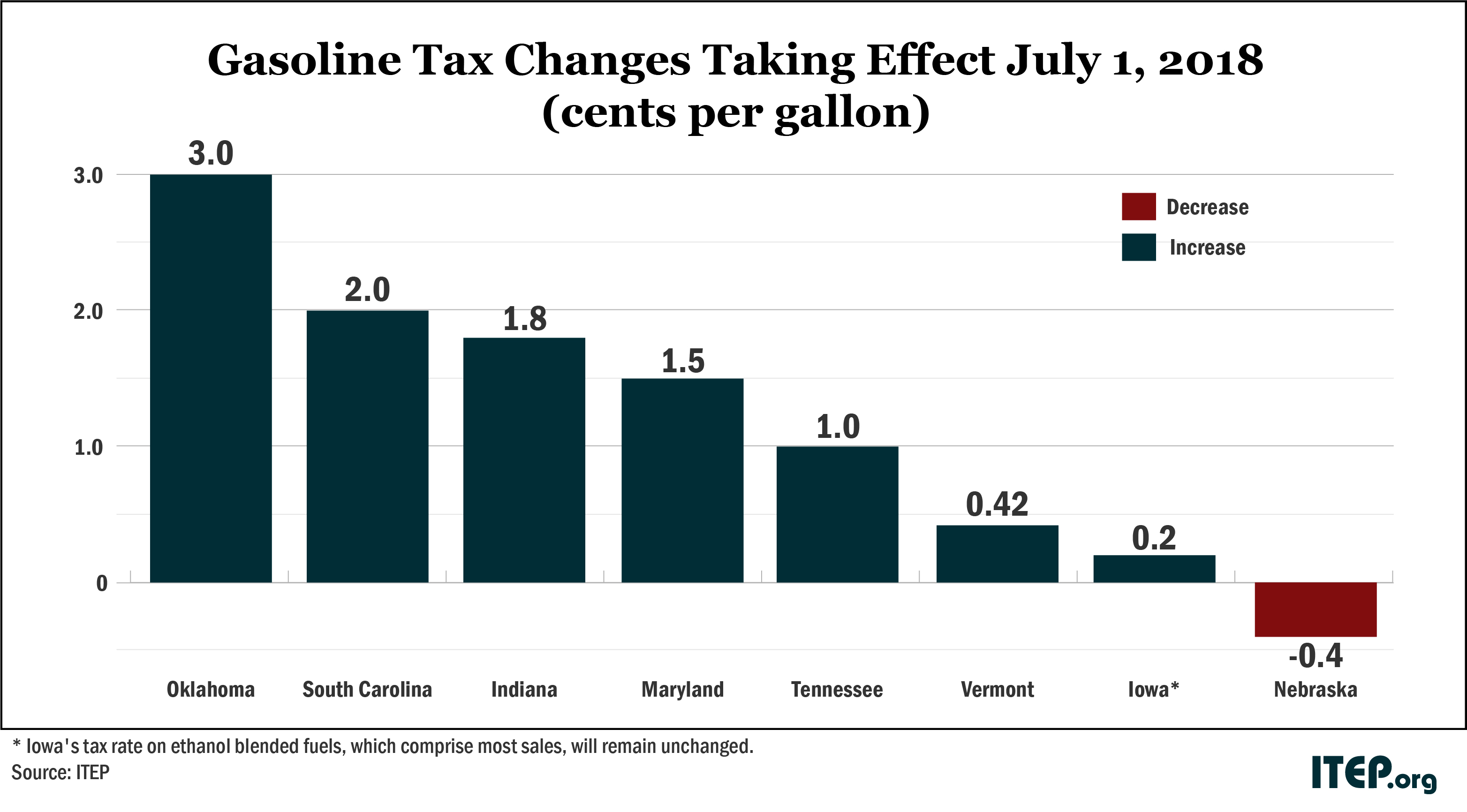

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Sales Taxes In The United States Wikipedia

Sales Tax By State Is Saas Taxable Taxjar

Nebraska Sales Tax Rate Changes April 2019

Taxes And Spending In Nebraska